Kelly Criterion Football

The Kelly Criterion aims to increase your betting bank at the optimal – or maximum – rate possible, which is a relatively aggressive approach. Most professional bettors would not risk anywhere near 10% of their bank on a single bet, whereas the Kelly formula rarely suggests low single digits. Kelly Criterion Calculator - Know Your Stakes Quickly Football Predictions Kelly Criterion Calculator - Know Your Stakes Quickly Kelly Criterion determines how much of a stake you should risk on a favorable bet, is a popular staking method which suggests that your stake should be proportional to the perceived edge.Kelly Criterion Calculator - Know Your Stakes Quickly Kelly Criterion determines.

The losses will come: NFLbets isn’t sure if this is officially a Rule Of Successful Gambling, but it certainly ought to be codified. So if you take your NFL betting seriously – and why wouldn’t you? That’s your money out there! – you look for every possible method of maximizing the wins in between the jags. To this end, NFLbets today considers the merits of the Kelly Criterion.

This mathematical formula was created by scientist John Larry (a.k.a. J.L.) Kelly Jr. in 1956 as a way to determine the correct amount of risk for long-term profit in a game of chance. Some four decades before the Kelly Criterion would be discussed anywhere beyond the mathematical intelligentsia, but today the formulae Kelly’s inspiration have spawned are used in financial speculation and, naturally, sports betting.

In its simplest possible form, the Kelly Criterion states that, on an even money bet, the percentage of the bankroll to bet is:

(Win probability x 2) - 1

So if the chance of winning on a single bet is 80%, the bettor should wager 60% of one’s bankroll. Note that if the formula is absolutely strictly applied, one would literally never make an even money bet, because the equation results in a zero when 50% as the win probability. (NFLbets knows not to bet the Super Bowl coin toss prop already, but mathematical proof backing the assertion is nice.)

Applying the Kelly Criterion to odds other than 1/1 requires a slightly more complex formula:

Both the usefulness and the limitations of the Kelly Criterion should be immediately apparent. Clearly are the formulae key to maximizing wins over the long term and if followed pragmatically can allow the bettor to cash in on upsets well more often than the average. The problem? These formulae offer nothing in terms of actual insight; the Criterion cannot determine which lines belie the hidden gem of an 80% chance to win.

However, as in the business world, the Kelly Criterion has been shown mathematically sound for betting. In a 2012 paper entitled Statistical Methodology for Profitable Sports Gambling, Fabián Enrique Moya considered various gambling strategies, with the Kelly System included as an “optimal” method of wagering – though ultimately Moya concludes that “some combination of Kelly and common sense is optimal.”

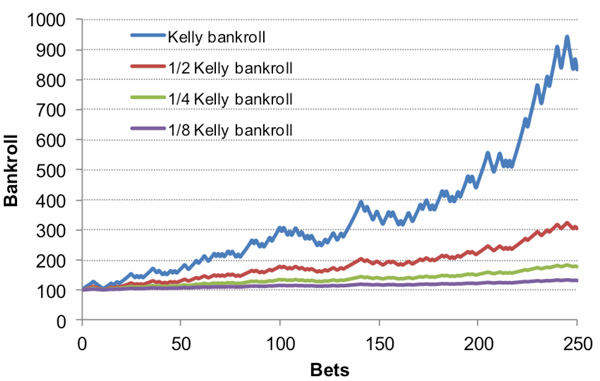

Moya’s work showed that mathematically, the Kelly Criterion is superior to other wagering systems because it virtually guarantees profit in the long term and also maximizes returns – as long as you’re winning. Like any other mathematics-derived betting formula, a few quick losses out of the gate, e.g. in the usually decidedly random-seeming NFL week 1 results, and that bankroll is busted early.

But a Kelly system can also cushion all except for the longest of losing streaks by curbing huge bets. Moya notes that “Staking plans that gamble less than the optimal fraction [as determined by Kelly Criterion] will also cause the bankroll to increase infinitely, albeit more slowly. However, gambling more than the optimal Kelly fraction will eventually led to bankruptcy.”

Moya points out that the prudent bettor can therefore adapt Kelly’s formulae, scaling back so as to not necessarily wager the entire bankroll every Sunday; he advances the increasingly popular half-Kelly method – the name speaks for itself – and NFLbets would like to put forth another spin, the Proportionate Kelly method.

The Proportionate Kelly method allows the bettor to cover as many bets as he/she would like at a time while also maximizing potential profits. Here’s how it works: add up all the optimal Kelly fractions and repropotion based on this new total rather than on 100.

For example, the bettor wants to make five bets with Kelly-based fractions of 50, 30, 30, 27 and 25, adding up to 162 “percent.” So rather than take out a loan to cover the 62% short, reproportion the percentages by dividing each number by 162. In this example, the fractions become about 31, 18, 18, 16 and 15, respectively, with 2% to spare.

Kelly Criterion Football Predictions

In the end, you’ll still have to make the predictions yourself. But particularly in bets such as Super Bowl player props, the Kelly Criterion is quite the useful tool in shedding light on rare opportunities of disproportionate risk/reward while limiting the risk – and, of course, in maximizing wins.

Kelly Criterion Football Player

–written by Os Davis